Investing in the stock market can be a powerful way to grow wealth, but the options can be overwhelming. If you have $2,000 to invest and are looking for a "set-it-and-forget-it" dividend option, selecting the right exchange-traded fund (ETF) can be crucial. While many investors focus on ETFs with high current yields, there’s a compelling case for considering ETFs that prioritize dividend growth over immediate income. One standout in this category is the Vanguard Dividend Appreciation ETF (NYSEMKT: VIG).

This article delves into why VIG is an excellent choice for long-term investors, especially those who can afford to wait for dividends to grow over time. We’ll also compare it with high-yield alternatives, outline the ETF’s strengths, and demonstrate how it can be a strategic addition to your portfolio.

Why Dividend Growth Matters

Dividends are a reliable source of passive income, but not all dividends are created equal. Many investors are tempted by high-yield stocks or ETFs, which distribute a larger portion of their profits as dividends. While these may provide higher immediate income, they often lack significant growth potential.

In contrast, dividend growth stocks—those that consistently increase their payouts—offer a unique combination of income growth and capital appreciation. This approach can be especially beneficial for investors with a long time horizon, as growing dividends compound over time, leading to significantly higher future income streams.

Understanding the Vanguard Dividend Appreciation ETF (VIG)

The Vanguard Dividend Appreciation ETF is an index fund that tracks a portfolio of large-cap stocks with a strong history of annual dividend growth. With 338 holdings, VIG provides a diversified exposure to companies with proven business models and excellent growth potential. Two of its largest sectors are technology and financials, both of which are integral to the modern economy.

Here are some key details about VIG:

- Expense Ratio: 0.06% (extremely low, maximizing investor returns)

- Dividend Yield: Approximately 1.8% (below the market average but poised for growth)

- Focus: Companies with at least a decade of consecutive dividend increases

VIG’s Top Holdings: A Snapshot of Strength

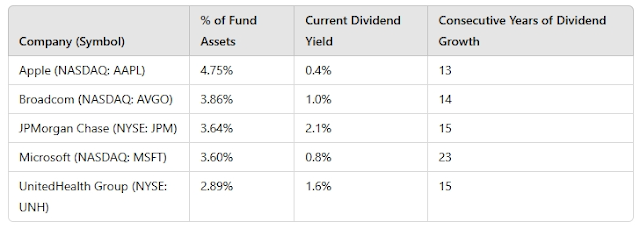

As of January 2025, the top five holdings of VIG include some of the most dominant and innovative companies in the world. Below is a closer look:

Why These Companies Shine

- Apple (AAPL): With its strong cash flow and iconic product lineup, Apple has increased its dividend by 113% over the past decade, showing a commitment to rewarding shareholders.

- Broadcom (AVGO): Known for its leadership in semiconductor solutions, Broadcom has consistently raised its payouts while maintaining high profitability.

- JPMorgan Chase (JPM): As one of the world’s largest and most stable banks, JPMorgan has tripled its dividend in the past 10 years.

- Microsoft (MSFT): With its dominant position in cloud computing and software, Microsoft boasts 23 years of consecutive dividend growth.

- UnitedHealth Group (UNH): A leader in healthcare innovation, UnitedHealth has increased its dividend more than fivefold over the last decade.

These companies represent the kind of robust, forward-looking investments that form the backbone of VIG’s portfolio. While their current yields may appear modest, their potential for long-term dividend growth and capital appreciation is unmatched.

The Power of Dividend Growth: A Comparison

To illustrate the impact of focusing on dividend growth versus high-yield investments, let’s compare VIG with its high-yield counterpart, the Vanguard High Dividend Yield ETF (NYSEMKT: VYM). Over the past decade, VYM has delivered an annualized total return of about 9.8%, while VIG has achieved 11.4%.

This difference may seem minor, but the power of compounding amplifies the disparity over time. Consider a hypothetical $10,000 investment:

As the table shows, VIG’s higher growth rate translates to significantly greater wealth over time. This is why dividend appreciation is such a powerful strategy for patient investors.

Who Should Invest in VIG?

The Vanguard Dividend Appreciation ETF is ideal for:

- Long-Term Investors: If you measure your investment horizon in decades, VIG’s growth-oriented strategy aligns with your goals.

- Younger Investors: Those in their 20s, 30s, or 40s who don’t rely on their portfolio for income can benefit from compounding dividends and capital gains.

- Diversified Portfolios: Investors who already hold high-yield investments may use VIG to balance their portfolios with growth-focused dividend stocks.

However, VIG might not be the best choice for retirees or those who depend on their portfolio for immediate income. In such cases, high-yield ETFs like VYM or real estate investment trusts (REITs) might be more suitable.

Why Now Is a Good Time to Invest in VIG

Market conditions in 2025 present a favorable opportunity for long-term dividend growth investors. Interest rates remain moderate, providing a stable environment for growth-focused companies. Additionally, the recent volatility in tech and financials has created attractive entry points for many of VIG’s holdings.

By investing $2,000 in VIG today, you position yourself to benefit from:

- Strong Fundamentals: The ETF’s holdings are financially sound, with robust cash flows and manageable debt levels.

- Potential for Dividend Growth: The consistent track record of dividend increases signals future income growth.

- Tax Efficiency: With its low turnover rate, VIG minimizes capital gains taxes, making it a tax-efficient choice for taxable accounts.

Conclusion: A Smart Choice for the Patient Investor

The Vanguard Dividend Appreciation ETF (VIG) is a standout option for investors seeking a low-maintenance, growth-oriented dividend investment. Its focus on companies with strong track records of dividend increases ensures a reliable and growing income stream over time. While its current yield may not satisfy income-focused investors, its potential for capital appreciation and long-term wealth generation is hard to ignore.

If you have $2,000 to invest and a long-term horizon, VIG offers a compelling blend of stability, growth, and diversification. By choosing this ETF, you can set your portfolio on a path toward financial growth, confident in the knowledge that your investment is backed by some of the most reliable and innovative companies in the market.

Comments

Post a Comment